What is sustainable investing?

Interested in putting your money towards a future you believe in? If so, you’re not alone. 81% of adults report wanting their investments to provide a financial return and do some good.

This is where sustainable investing comes in (sometimes described as “ESG investing”, where ESG stands for environmental, social and governance). Just as you might choose eco-friendly appliances or buy your clothes second-hand, sustainable investing allows you to make financial choices that align with your values. This means looking beyond purely financial motives and investing with an eye to social and environmental factors such as environmental protection, energy consumption, health outcomes and more.

While other sustainable practices are becoming increasingly popular and accessible, sustainable investing is still uncharted territory for many of us. Transparency can be a problem, making it difficult to understand the true impact of your choices, both on your bank account and on the wider world.

This guide aims to bridge this information gap, and help you feel more confident deciding what a more sustainable financial future might look like for you. We’ll look at:

- The most common types of sustainable investing

- The risks they involve

- The returns you can expect

- The work being done to increase trust and transparency in sustainable investing

What are the different kinds of sustainable investing?

There is a range of sustainable investment products to suit your values and investment objectives. Most aim to use some blend of the following approaches in order to do more good than conventional investments:

Negative Screening:

Also known as divestment, negatively screened investments filter out non-sustainable sectors, companies, or practices. For instance, a fund using this approach might exclude high-polluting industries or companies that fail to meet diversity standards.

Tilting:

Sustainably tilted investments don’t exclude non-sustainable sectors entirely, but make sure to hold more of the most sustainable or fastest improving companies within each sector. A sustainably tilted fund might still invest in oil and gas companies, for example, but with larger holdings in companies acting quickly to align themselves to energy transition targets.

Positive Screening:

Also known as impact investing, this approach involves focusing investment in companies or sectors that are actively addressing sustainability issues. A positively screened fund, for example, might invest primarily across renewable energy, sustainable agriculture, public transport, or social enterprise.

A thematic fund also invests in companies addressing sustainability issues, but does so in a specific sector or theme. You might find a thematic fund, for example, that specialises in backing technologies improving access to clean water.

What returns can I expect from sustainable investing?

More and more of us want our investments to do some good. But most of us aren’t in a position to entirely forget about investing’s other goal: looking after the financial futures of ourselves and our loved ones. So it would be good to know how much it costs to invest with an eye to sustainability. Is it possible to make an impact and still generate returns comparable to those of conventional investments?

Different sustainable investments will have different risk-return characteristics, and the performance of each will depend on external factors that are difficult to predict: the costs of climate change and energy transition, for example, or popular attitudes towards poor governance and social impact. So blanket statements that promise inevitable outperformance or underperformance should be viewed with caution. It may therefore be necessary to select your investments very carefully and read resources like the WallStreetZen’s stock picking guide for example to be informed.

For example, you might think that your money can only ever do more good for the wider world if it does a little less good for your bank account. But the evidence on this is more mixed: while past performance is no guarantee of future results, a 2023 review of over 150 studies found that, on average, socially responsible investing has neither outperformed nor underperformed the market.

What impact can I make with sustainable investing?

Having read about the potential returns you can make, you might be wondering what impact your money can have on the wider world. Sustainable investments can help nudge companies to make positive changes: to become more environmentally friendly, socially responsible, or well-governed.

For example, if you choose to invest in renewables, you’re helping to support the transition to cleaner energy, reducing carbon emissions, and tackling climate change. If you look to companies that are prioritising fair labour practices, you’re signalling to companies that investors won’t ignore their social impact.

As more and more people invest in this way, more businesses could be nudged to make these positive changes, helping to build a more sustainable future for all.

Sustainable investing and social media

Social media can be a powerful tool for raising awareness and sharing knowledge about sustainability issues. But it can also accelerate the spread of misleading information and poor-quality financial promotions.

We are already seeing an increase in bloggers and influencers using social media to promote investment products, particularly to younger people. And as interest in sustainable investing grows, the more likely we are to see “finfluencers” discussing sustainable investing or promoting sustainable investment products.

It is worth bearing in mind when engaging with this content that influencers are usually trying to reach the widest possible audience, whereas the right investment product for you is going to depend on your particular goals and financial circumstances. Influencers may also have a financial interest in promoting products even when they are unsuitable for their audience.

So while social media might be the jumping-off point for your sustainable investment journey, it is important to consider a range of information (including from regulated sources like fund managers and distributors) before making a financial commitment.

What is greenwashing and why should I care?

Sustainability is a topic of great and growing importance to today’s consumers. Businesses are responding to this trend by talking more and more about the sustainability of their products.

But not all their sustainability claims can be taken at face value. “Greenwashing”, where products are marketed as more sustainable than they really are, is a way for businesses to tap into this market without having to match words with actions. And this harms those consumers trying to make informed choices about their sustainability footprint.

Investment products are not immune from the threat of greenwashing. Just as you might be surprised to discover how much “recyclable” packaging isn’t accepted at your local recycling centre, you might be surprised to find your “ABC Green Fund” includes companies drilling for oil in the Arctic, logging in the Amazon, or lobbying for the rollback of worker protections.

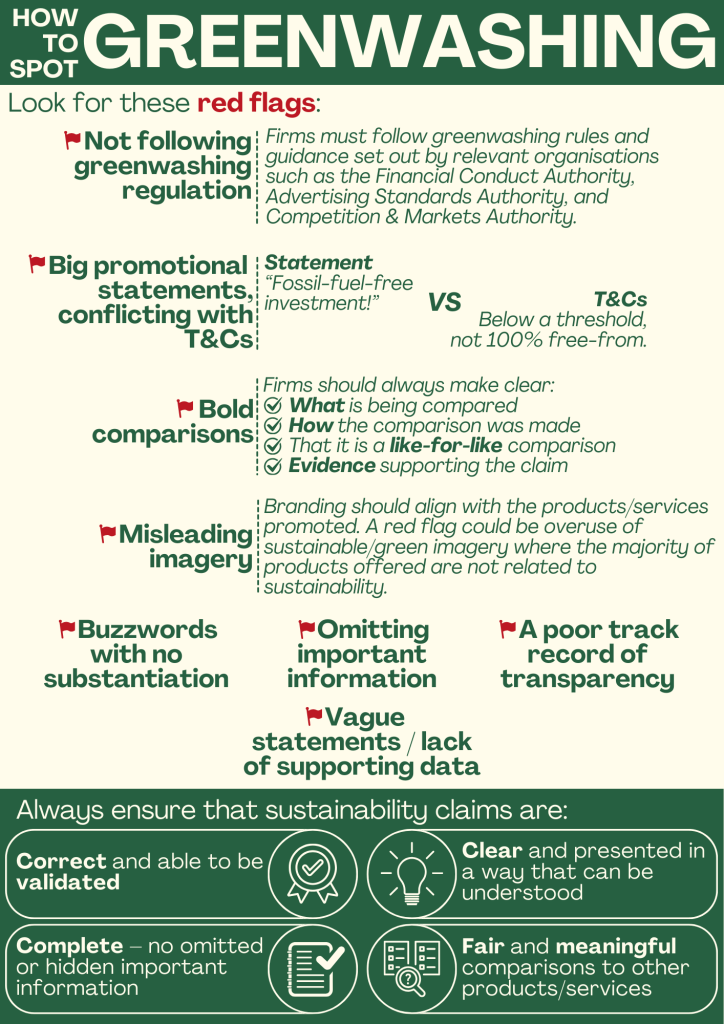

How can I avoid greenwashing?

The following details some of the ‘red flags’ to look out for along with what makes a good sustainability claim. Keep this in mind when exploring sustainable investment products.

What is the Financial Conduct Authority doing?

The Financial Conduct Authority (“FCA”), which regulates financial services in the UK, has recently introduced new rules to tackle greenwashing and make it easier for you to find products that meet your sustainability objectives.

The anti-greenwashing rule:

From 31 May 2024, the anti-greenwashing rule requires FCA-authorised firms to ensure that their sustainability references are fair, clear, not misleading, and proportionate to the sustainability profile of the product or service on offer.

The labelling regime:

From 31 July 2024, qualifying UK funds are able to display one of four sustainability labels. These will help you to differentiate between funds with different sustainability goals. For a fund to use one of these labels, it will have to meet criteria set by the FCA. These criteria set a high bar for commitment to the sustainability goal, helping to build confidence that your investment decision will have a real impact.

The labelling regime applies to funds based in the UK. However, the UK government intends to consult on expanding the regime to include overseas funds marketed here.

If you want to know more about the labels, click here to read more on the FCA’s website.

What’s next for you?

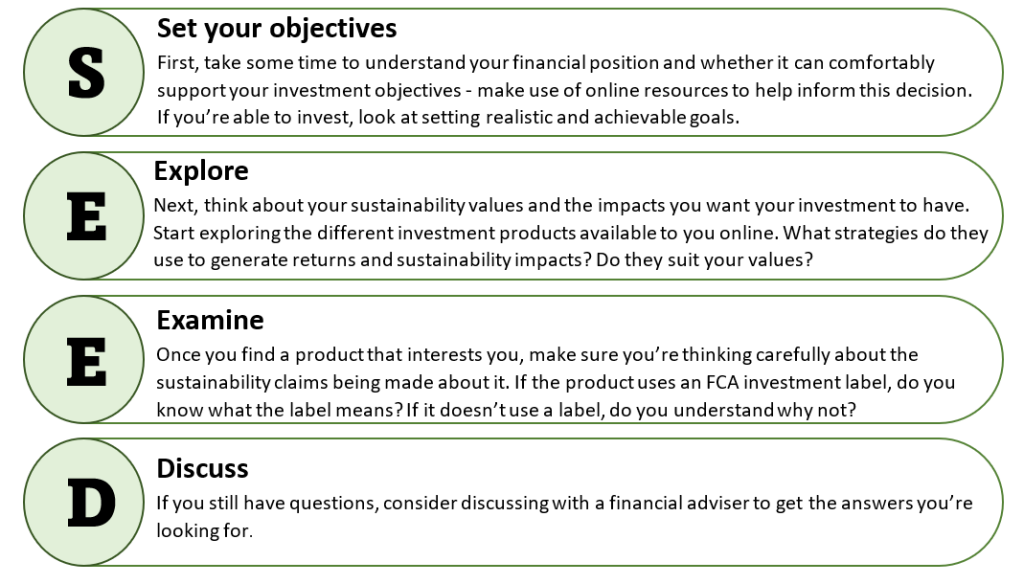

Still interested in investing sustainably but not sure where to go next? Follow the steps below to help plant the SEED for your investing journey…

Editorial Note:

This article has been produced by graduates and apprentices as part of the Financial Conduct Authority (FCA) CEO Challenge. It is a mandatory part of our Graduate and Apprentice Development Programme. The FCA sponsors the challenge to encourage colleagues to come up with innovative ideas to help members of our community. The content does not form part of any FCA policy.

![]()

Author Profile

- Online Media & PR Strategist

- Blogger and Educator by Passion | Senior Online Media & PR Strategist at ClickDo Ltd. | Fascinated to Write Lifestyle Blogs in News & Education I have completed a journalism summer course at the London School of Journalism and manage various blogs.

Latest entries

Green GuidesMay 29, 202519 Best Eco-Friendly Products, Services & Gifts – With Special Deals

Green GuidesMay 29, 202519 Best Eco-Friendly Products, Services & Gifts – With Special Deals List postMay 28, 202510 Everyday Items with PFAs (‘Forever Chemicals’) and Green Alternatives

List postMay 28, 202510 Everyday Items with PFAs (‘Forever Chemicals’) and Green Alternatives List postMay 22, 20258 Eco-Friendly & Energy-Saving Home Gadgets for Daily Routines

List postMay 22, 20258 Eco-Friendly & Energy-Saving Home Gadgets for Daily Routines Green LivingMay 15, 20258 Healthy BBQ Swaps for a Cleaner, Greener, Guilt-free Grillfest

Green LivingMay 15, 20258 Healthy BBQ Swaps for a Cleaner, Greener, Guilt-free Grillfest

Leave a Reply

You must be logged in to post a comment.